There are two types of tasks we handle at work. The first is important work we do every day to make business work – registering invoices, settling transactions, reporting taxes etc. Because we do it often, we are specialists in it, and we handle it without any problems. But there is another kind of work which is no less important but needs to be done as accurately as any other. The Year-end close process becomes actual only once a year when employees are keeping their noses to the grindstone, with almost zero opportunity to spare some time and get familiarized with the procedure of closing in the accounting system.

That is why it is crucial to be aware of the tool’s capabilities and know the process in general before it becomes urgent. So, let’s deep down and optimize year end close in D365FO.

First, the closure of a year is not the responsibility of one employee. In fact, this process involves everybody from warehouse worker to financial director. To close the year, we must ensure that all the work has been done and all related documents have been registered. This is why it is important to have a check list of all necessary tasks to be completed. And this is from where we start.

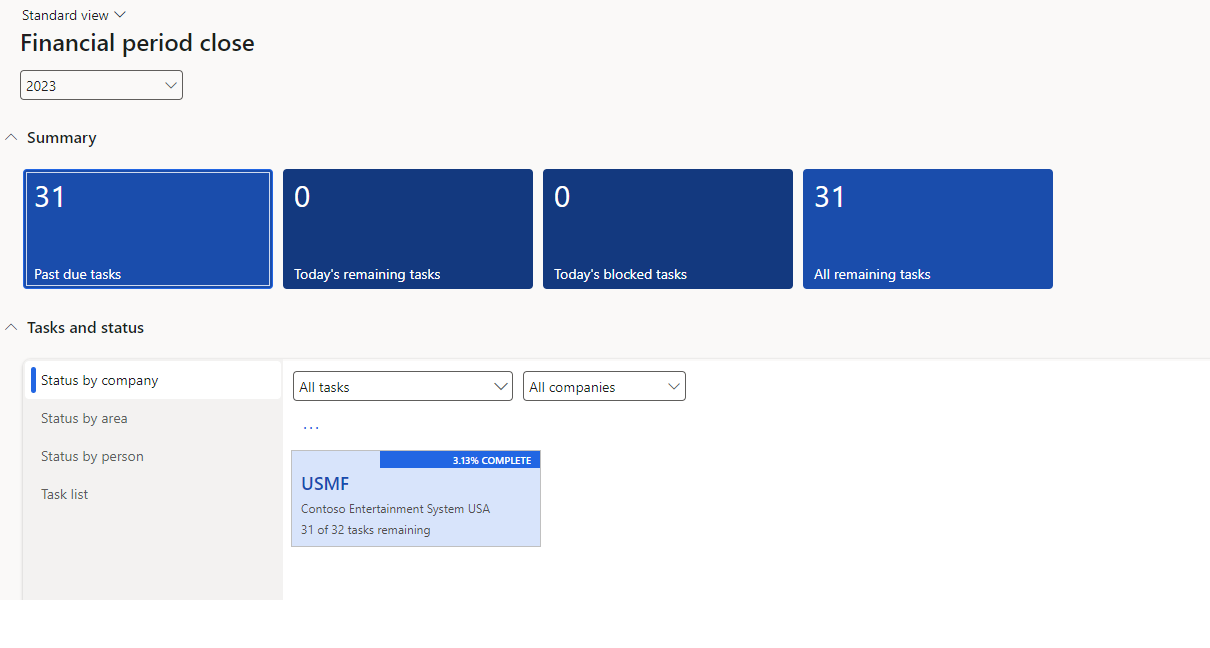

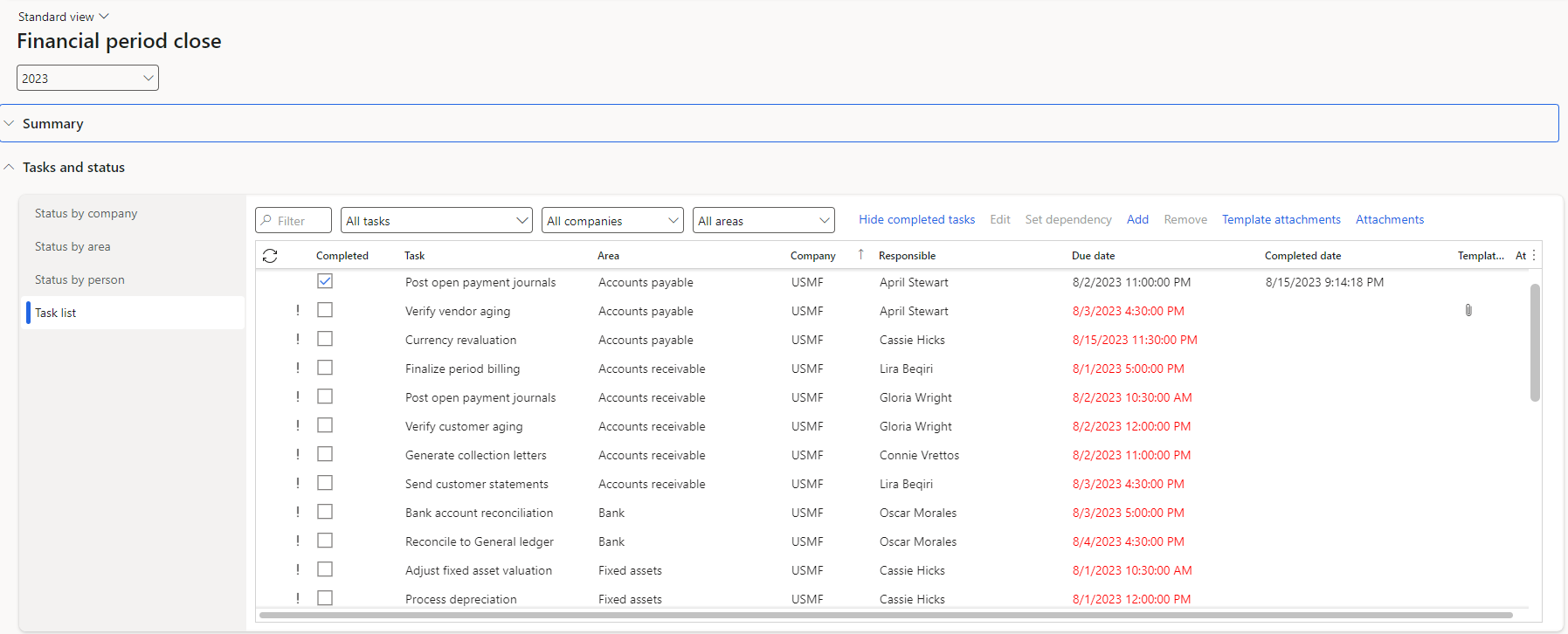

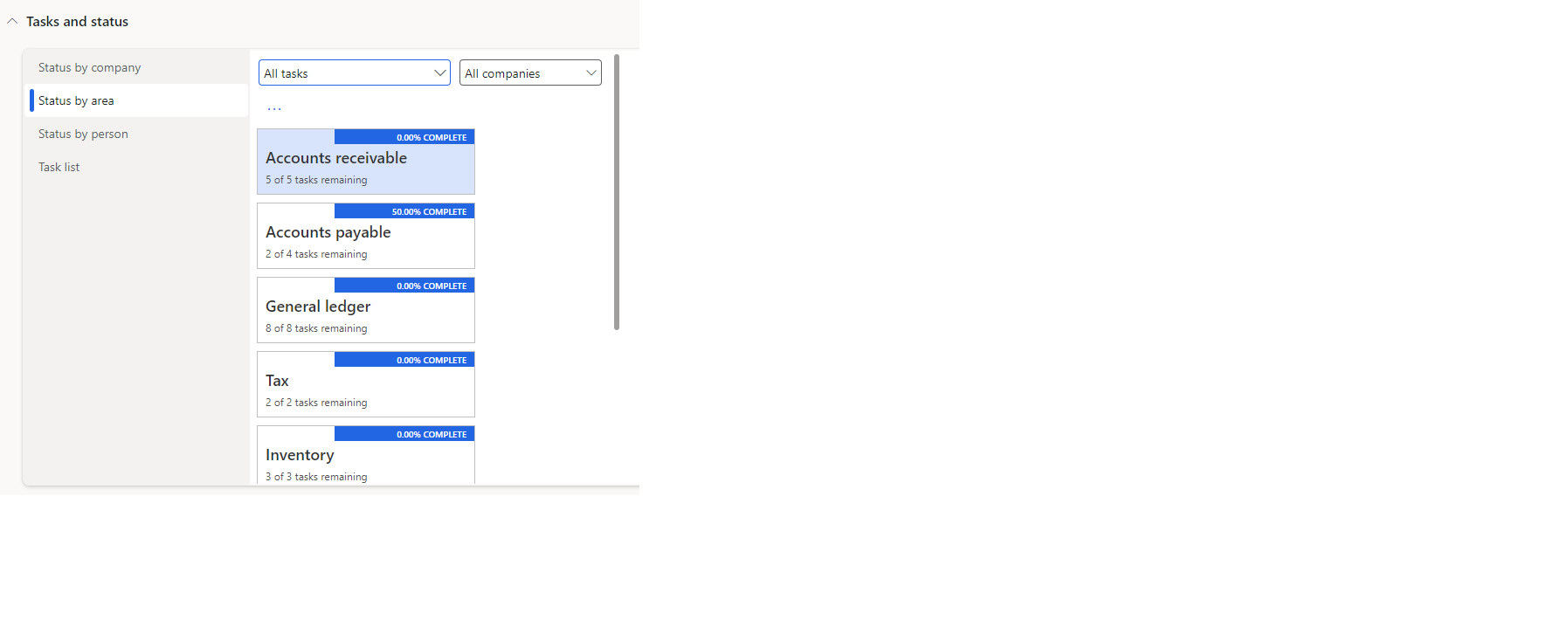

FO offers a configurable workspace which will contain the list of assigned tasks:

As an advanced user you can see all the tasks assigned to all responsible employees across all companies and areas. Such handy view simplifies the control and communication procedure. There is no need to gather information concerning the closure procedure from different departments – all related information can be accessed via Financial period close workspace.

As an option it is possible to edit the task – assign to a different employee, change the completion date etc. It is easy to track the status of closing procedure by a company, a person, or an area:

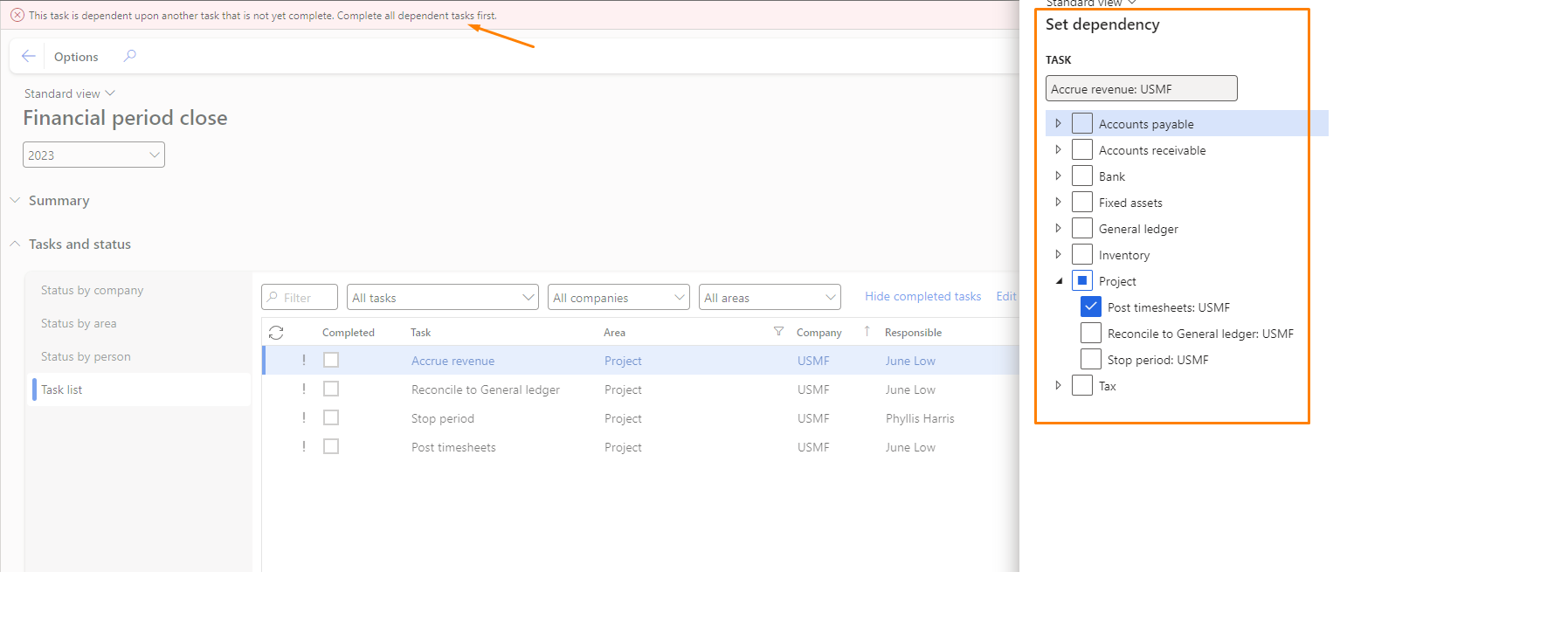

Also, there is a configuration to set a dependency of tasks. For example, it is not possible to complete the task `Accrue revenue` if timesheets are not posted. You can set up a chain of dependency to organize the correct process flow.

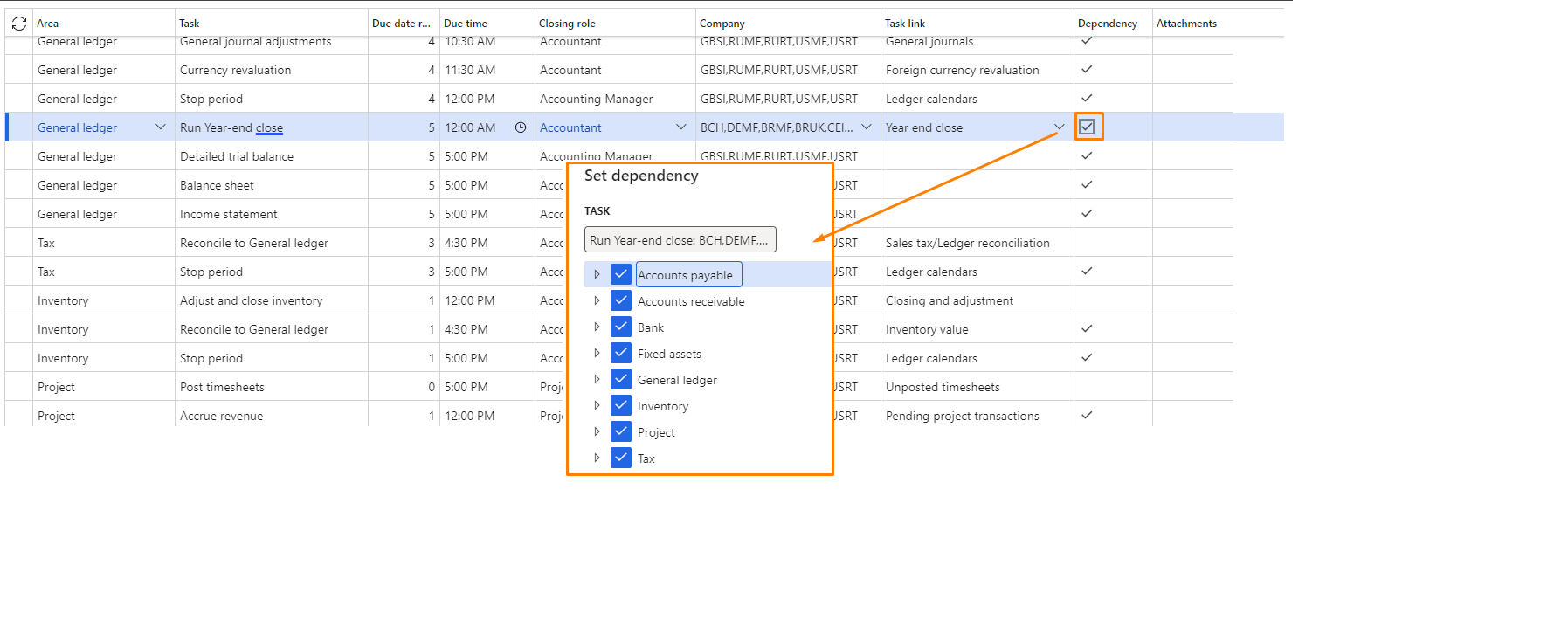

As soon as all tasks from Finance period close workspace completed the Year-end close procedure must be run. It can be added to a workspace with dependency after all other tasks:

Year-end procedure rolls the balances over the new year and posts retained earnings and therefore is mandatory. You can register documents and post transactions in a new year before Year-end close completed provided that the period is open, but since the opening balances are not rolled over the trail balance will be incorrect.

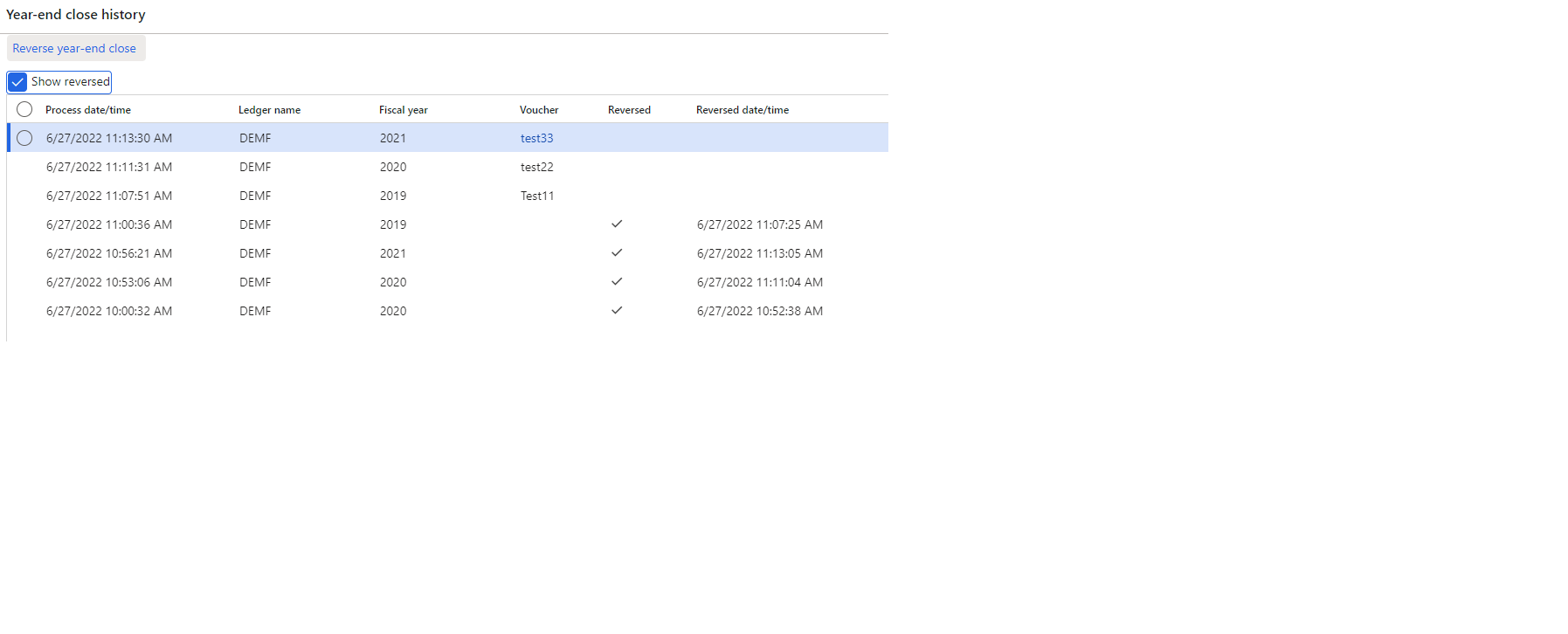

It is possible to review the history of closure, reverse and rerun the procedure.

The described is a standard FO Year-end procedure which is being enhanced during the time.

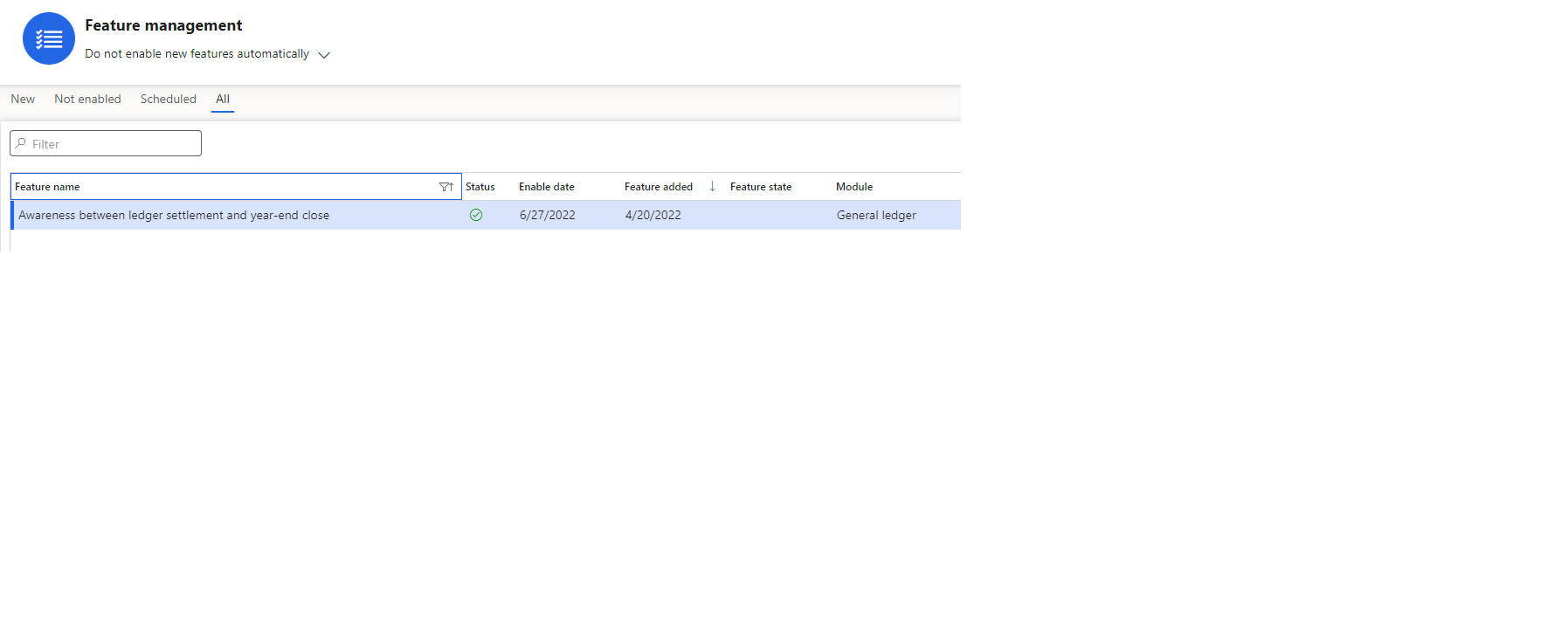

Among such enhancements there is “Awareness between ledger settlement and year-end close” feature which allows you to have detailed opening balances after running of Year end close. Without the feature balances are rolled over based on account or combination of account and financial dimensions and represents the total amount for a given combination.

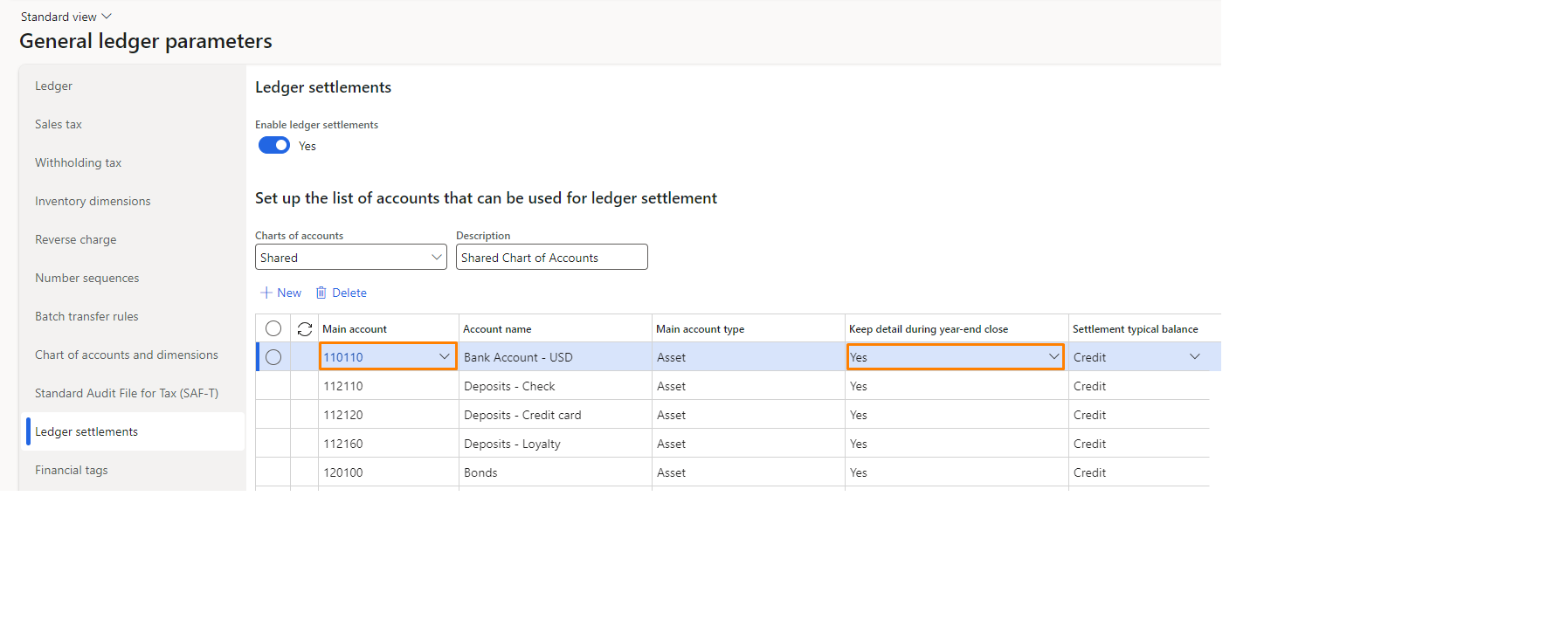

If the feature is enabled a new column ‘Keep detail during year-end close’ will be added by the main account section on the Settlement tab in the General ledger parameters.

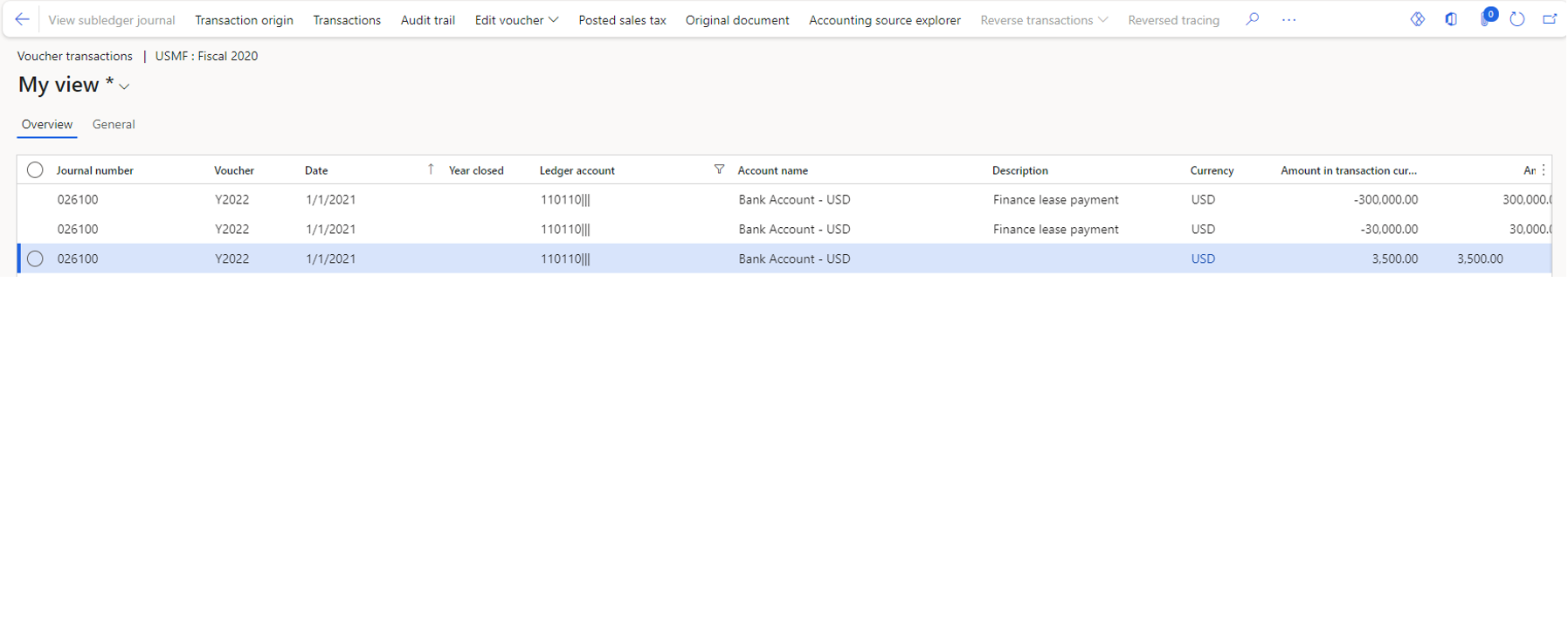

If the parameter is set to Yes the balances will be represented in details separately for each unsettled ledger transactions:

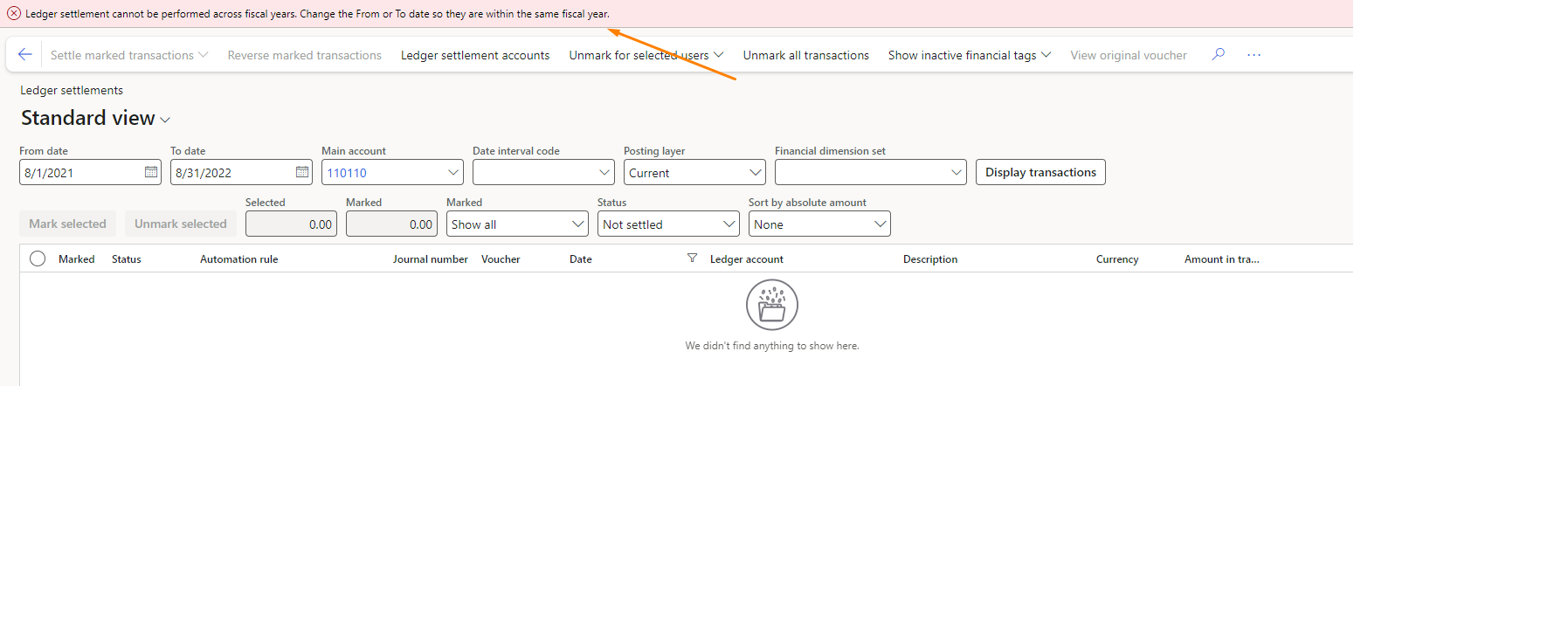

Consequently, enabling this feature means that it is only possible to settle transactions within one fiscal year. This is because now you can settle with an opening balance transaction. If you try to settle transactions from different years, D365FO will give an error message.

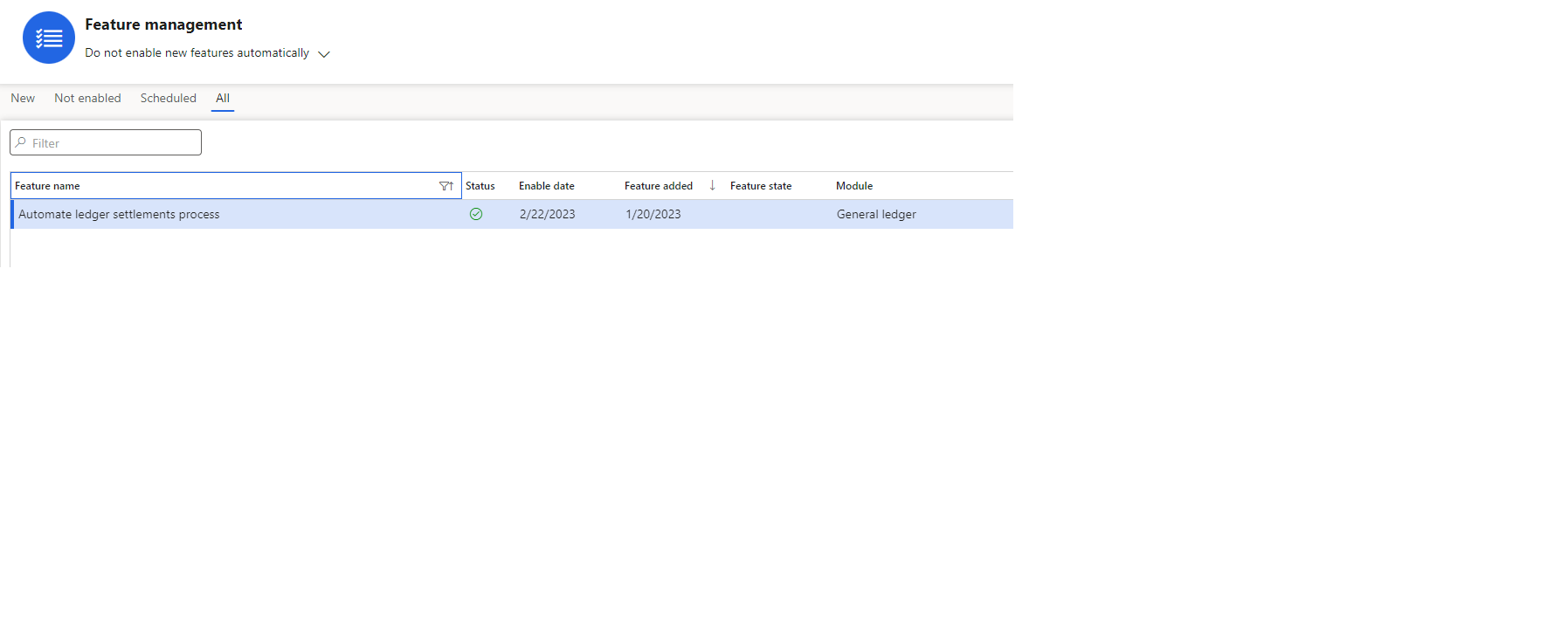

In addition, it is possible to enable automatic process of ledger settlements via Feature management:

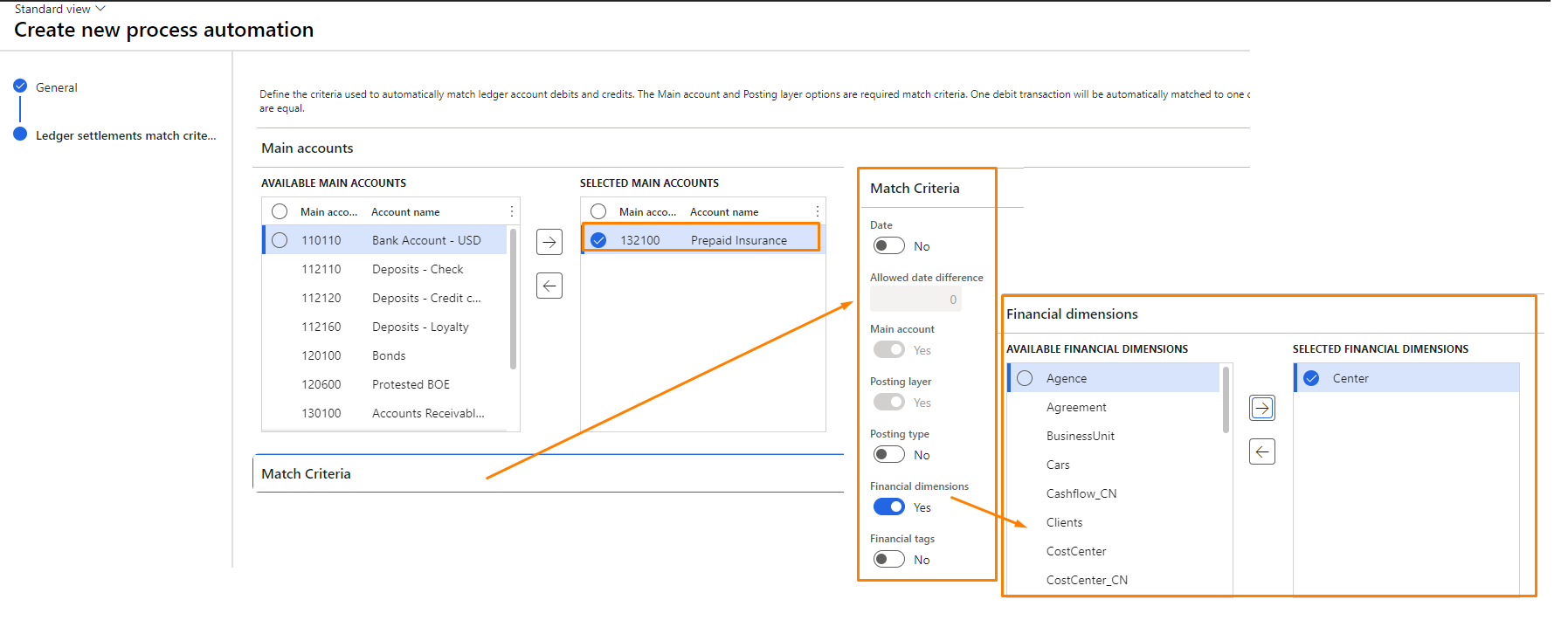

This feature is related to the “Awareness between ledger settlement and year-end close” feature and therefore must be activated after. After enabling it is necessary to create a rule for process automation and set up the matching criterias:

Another important aspect in how to optimize year end close is performance.

Year-end closing is always done in batch and requires significant system resources. Therefore, we should think about how we can minimize the impact of the year-end procedure on system performance.

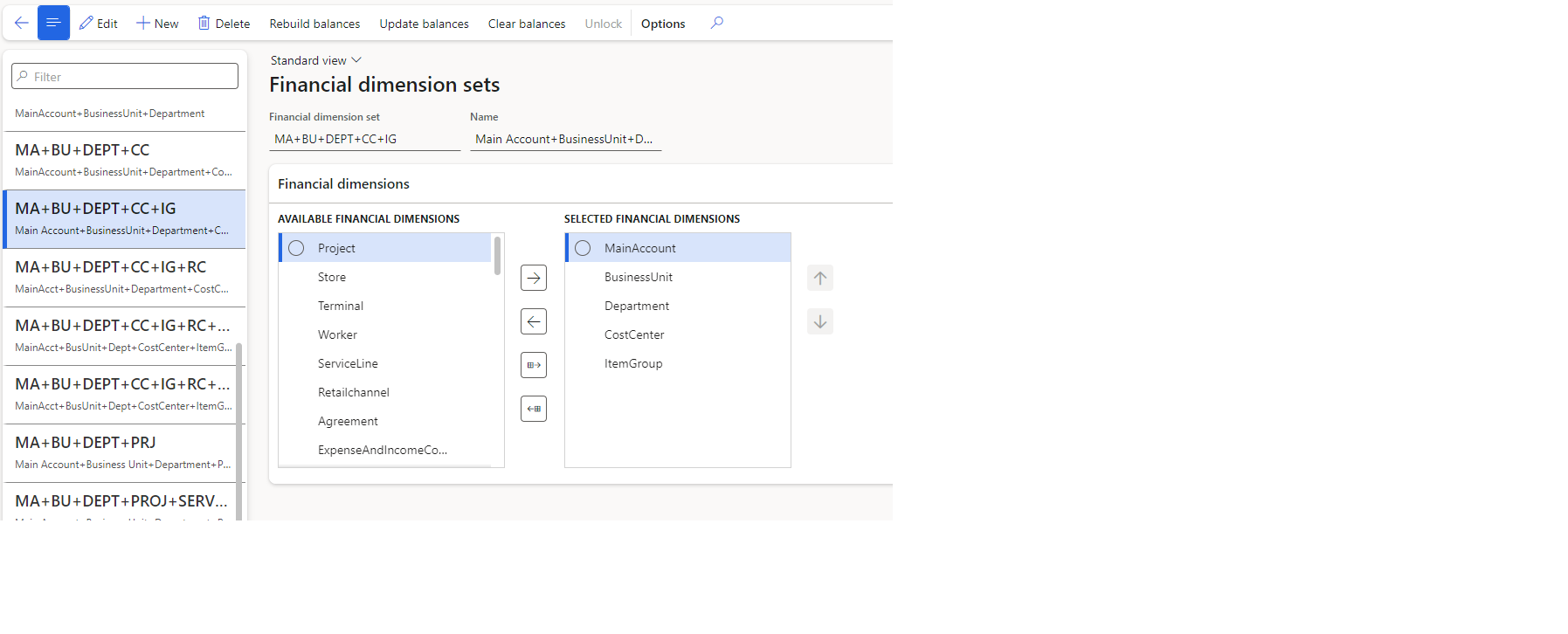

One tip is to maintain as many financial dimension sets as the company uses. Since the closing of the year generates opening balances in terms of sets of financial dimensions, the more sets the more time it will take to complete the procedure.

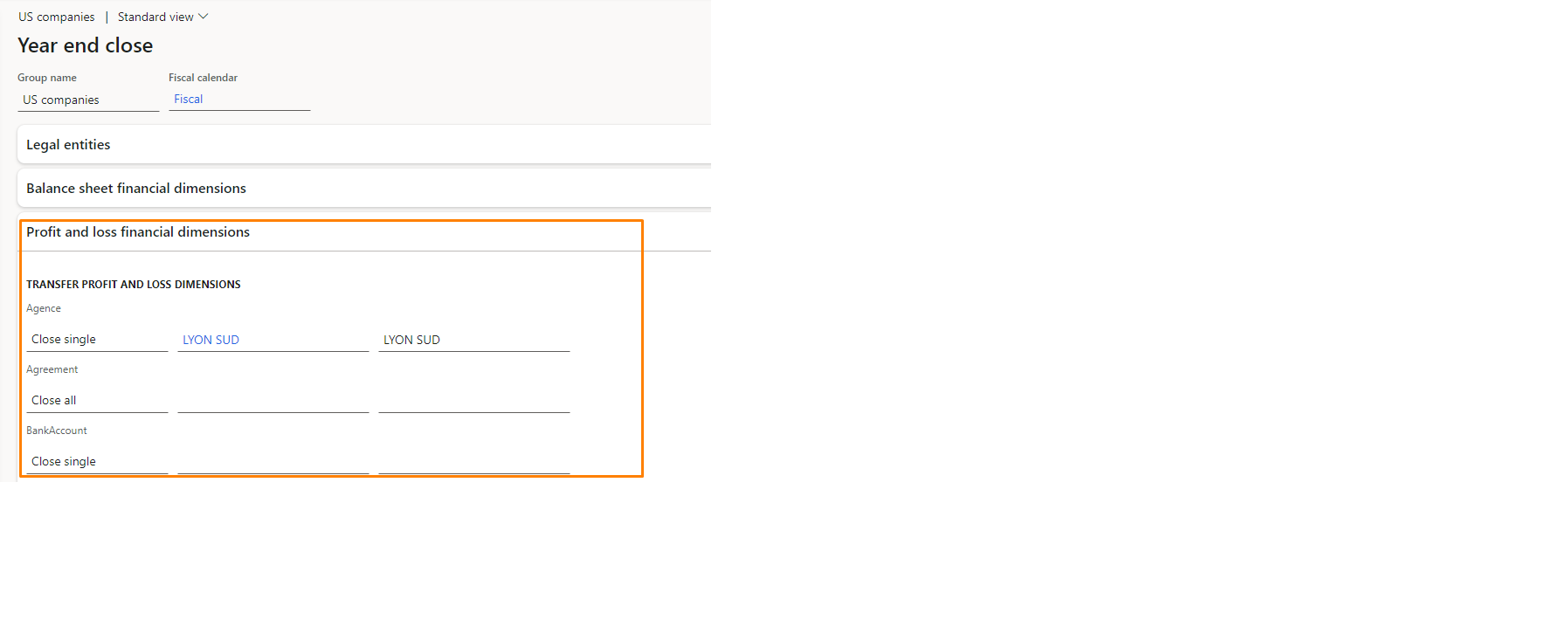

Another recommendation is a smart usage of a “Profit and loss financial dimensions” configuration on a Year end close. Some customers have confusions concerning the way it is used. Therefore let`s discuss what the options are intended for. On the screen below there are three financial dimensions with different configurations:

So the advice is to set as many of your financial dimensions to “Close single” as possible.

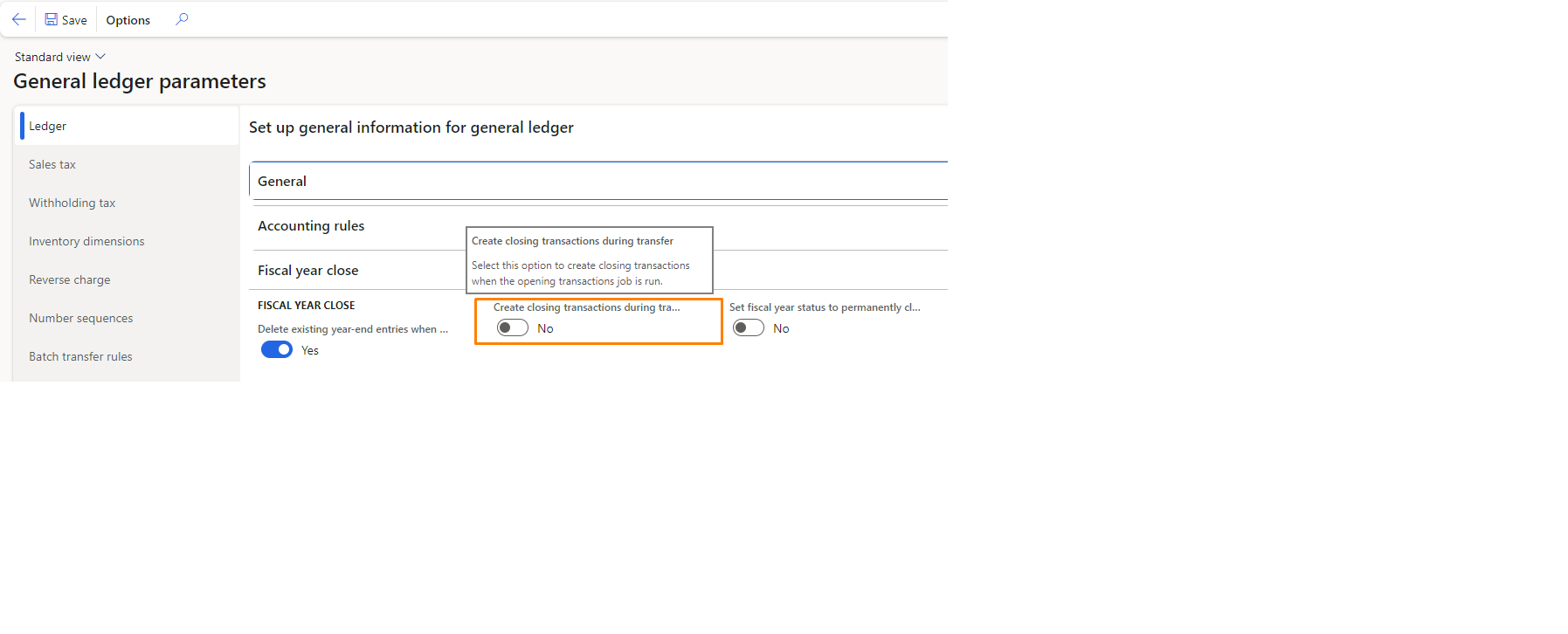

One more hint is to have the next parameter set to No. When it is set to Yes the system creates not only opening transactions in a new year but also closing transactions in the previous year. Obviously it requires more time. So if it is not mandatory to have closing transactions it is better to set it to No.

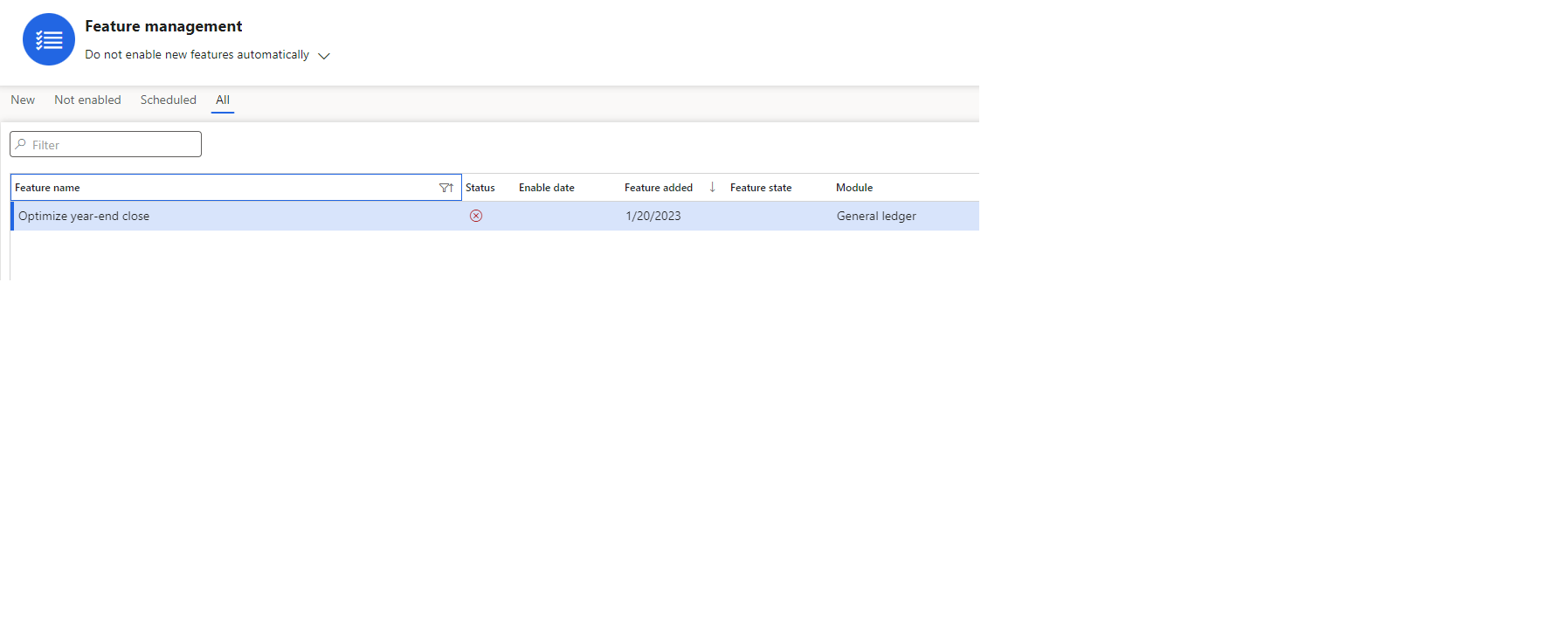

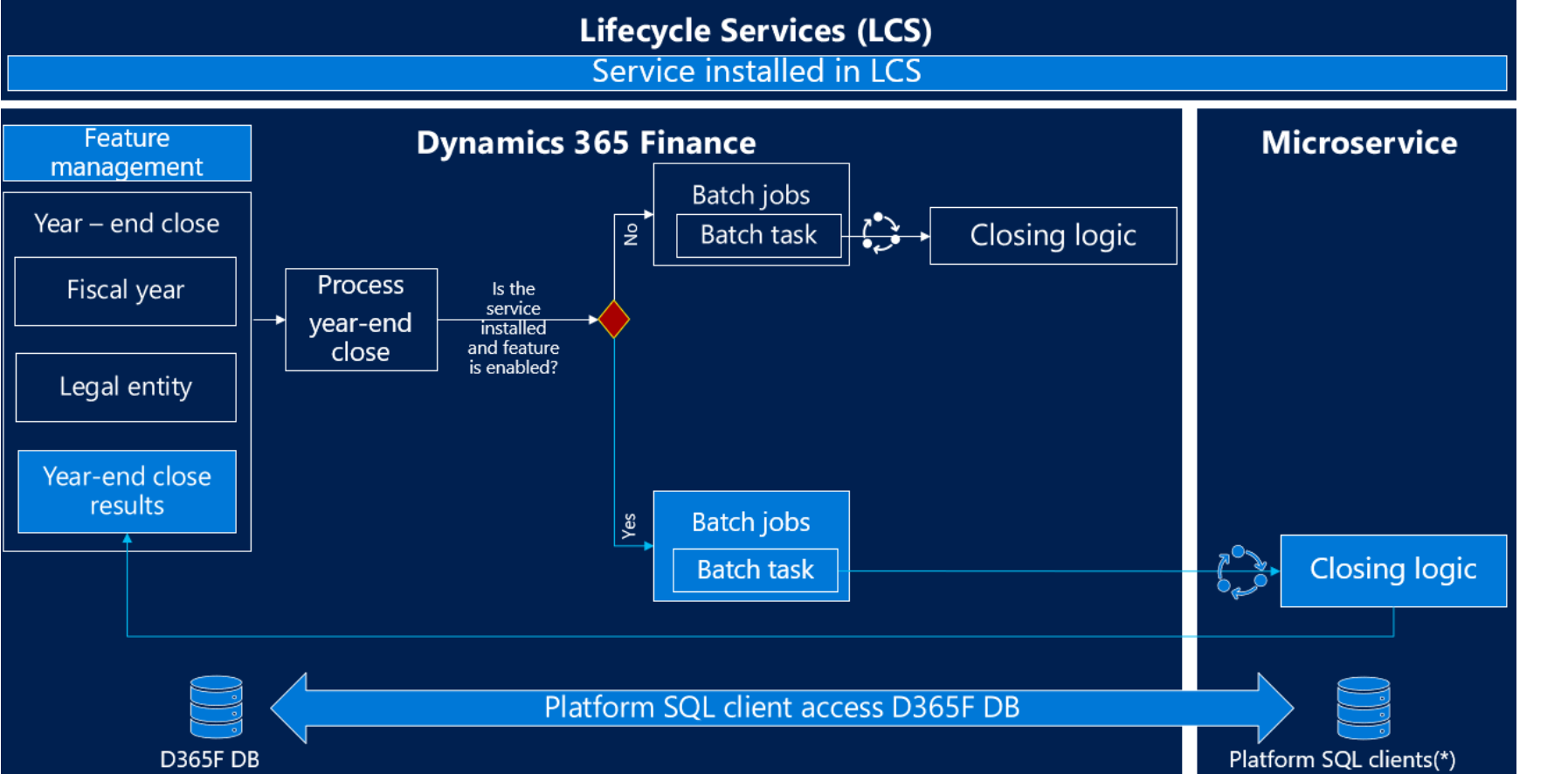

Finally, the recently introduced feature “Optimize year-end close” is recommended to be enabled. It uses microservice technology and gives next advantages:

The picture below shows the comparison between current and new approach to YEC procedure. And the main purpose is to improved performance and minimized impact on the SQL database during year-end close processing.

Year-end close process is one of the most important tasks that must be completed in any business. Microsoft Dynamics 365 Finance & Operations provides a flexible tool that allows you to customize the YEC process to your needs, while facilitating the work of users and without additional load on the system.