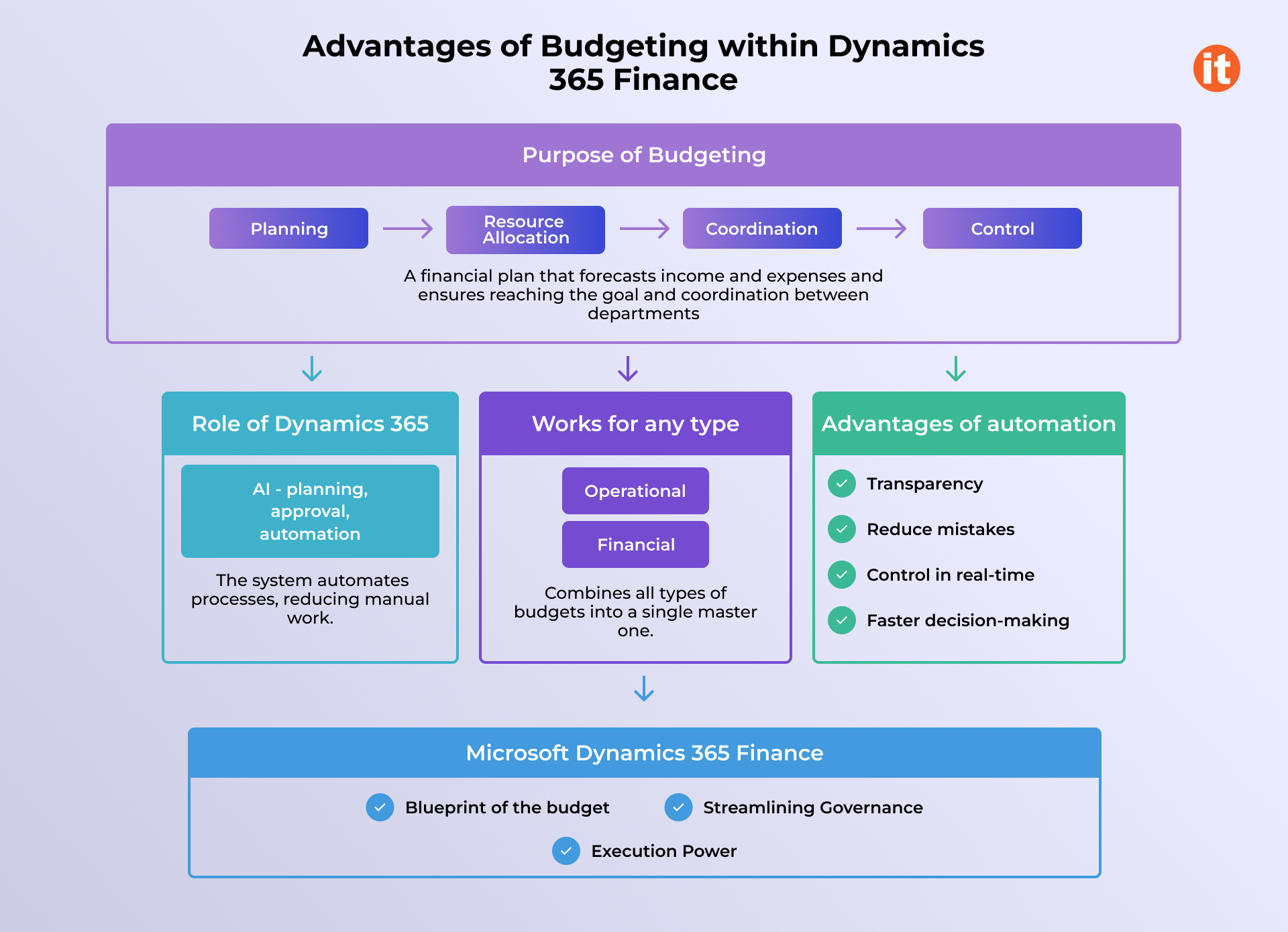

Unlock more innovative financial management through automation in Microsoft Dynamics 365 Finance and Operations. Explore how its budgeting features improve planning accuracy, strengthen spending governance, and enhance cross-departmental coordination.

What’s the role of Dynamics 365 Finance?

Within Dynamics 365 Finance, budgeting becomes a connected workflow rather than a static report. The platform streamlines every stage—from data preparation and approvals to ongoing spending control—by embedding automation into routine financial tasks. It’s not only about organizing all steps into one system, but also about uniting all financial reports into a single ecosystem that covers financial planning beyond budgeting.

That’s why Dynamics is the next step for companies that have outgrown simple Excel sheets and need to scale up. Because it can not only automate routine tasks and reduce manual work but also keep everything in one place, where each team member has access and can do their part. So two major advantages stand out: simplicity and connectivity.

Simplify every stage of work

Talking about budgeting, we can roughly divide it into three stages.

Blueprint of the budget

During the crucial forecasting phase, the system automatically generates budget plans to outline the expected revenue and expenditure cycles clearly. It streamlines initial data preparation by collecting information from current periods, integrating seamlessly with tools like Microsoft Excel and Word, and leveraging previously created budgets to minimize manual input and ensure consistent allocations, saving significant time and eliminating errors.

Furthermore, the system accelerates the process by leveraging AI to generate budget drafts and develop baseline scenarios, while supporting multi-scenario planning and integrating advanced forecasting tools to model potential financial outcomes and enable quick adjustments to evolving situations.

Streamlining governance

During the crucial approval phase, you can fully customize your workflow to meet specific organizational needs, allowing the system to automatically move the budget through preplanned steps while maintaining control and governance; for instance, the system will notify the responsible person to review and confirm the budget and automatically update its status according to your customization.

This structured process is further optimized by defining a specific budget planning hierarchy for each process—which can be different from the standard organizational structure—to ensure the most efficient route for data aggregation and distribution; critically, once approval is granted, the system guarantees that the budget cannot be altered, preserving its integrity.

Execution power

The final and essential step of control begins once the budget is approved, playing a key role in everyday operations by preventing overspending before it occurs. This core feature, often referred to as hard control, involves an automatic check against the budget immediately before each transaction. You can permit certain user groups to overspend, making it soft-controlled. In any case, managers can stay on top of everything by tracking real-time spending, which compares actual expenses to the confirmed budget.

Furthermore, organizations can tailor financial discipline by customizing control functions to specific needs, clearly identifying what, when, and where to check in the budget, and even choosing to track only particular transactions for focused oversight.

Create as many different budgets as necessary – everything will be within reach

Organizations can tailor budget structures to reflect their operational reality—combining strategic master plans with detailed departmental forecasts. It can utilize multiple budgets and methods simultaneously or focus solely on the main ones. This part is customizable and adaptive to your needs. Additionally, it doesn’t matter who initiates the creation – one of the departments or executives – system support both: unification of local budgets into a master budget or dividing the one into smaller departmental.

Dynamics 365 supports your budgeting process at every stage, so set measurable goals and create the budgets you need. Monitor the work and perform the final analysis in a single ecosystem.

Alter your business by effective budgeting

Finally, a budget serves as a forward-looking map of income and expenditure, guiding how resources are allocated and monitored across the organization. Its primary goal is to give management the control needed to oversee cash flow and prevent expenses from surpassing income.

Providing accurate financial data supports better decision-making about operations, spending, and investments. It is vital for strategic planning and aligning all financial activities with the company’s long-term goals and organizational priorities. This helps ensure the effective use of resources for projects with the highest potential ROI. Additionally, it serves as a benchmark for evaluating performance by comparing actual results with planned targets.

Effective budgeting also plays a crucial role in risk management by helping identify potential financial issues and prepare for market fluctuations. A well-structured, documented budget enhances credibility and attractiveness to lenders and investors, facilitating access to funding.

The outcomes

Implementing an automated budgeting system offers key benefits for the company, mainly through enhanced efficiency and oversight. The process becomes faster and less labor-intensive, enabling quicker approval cycles thanks to well-defined workflows that ensure traceability of each step and clear responsibility assignment. Automation also minimizes manual errors, boosting accuracy in financial planning. After the budget is set, the system provides powerful control features such as real-time spending monitoring and proactive limit enforcement (hard control), which ultimately facilitate more effective decision-making by management.

The true power of modern budgeting is in its digital transformation, with Dynamics 365 Finance and Operations playing a vital role. The system automates and connects every stage of the process, turning a company’s budgeting from a periodic, spreadsheet-based task into a continuous, strategic, and well-controlled process that ensures all financial activities align perfectly with long-term organizational goals and are prioritized for maximum ROI.